- What Does $30 Copay After Deductible Mean

- $25 Copay Before Deductible Mean

- 30 Dollar Copay After Deductible Mean

- $30 Copay After Deductible Means

Note:

Pediatric – $25 copay after deductible. Adult – not covered. Pediatric – $20 copay. Adult – $20 copay. Vision Exams Pediatric – $25 copay after deductible. Individuals Under 30. Eligible Service Areas Within New York City’s five boroughs (the Bronx, Brooklyn, Manhattan, Queens, and Staten Island). You start paying coinsurance after you've paid your plan's deductible. How it works: You’ve paid $1,500 in health care expenses and met your deductible. When you go to the doctor, instead of paying all costs, you and your plan share the cost. For example, your plan pays 70 percent. The 30 percent you pay is your coinsurance.

1) Plan payments for covered health services are based on usual and customary charges.

2) Should there be a conflict between this summary and the Plan Document, the Plan Document will be the final authority.

* Custodial care is not a covered health service

** Shingles vaccination is covered under Medical and Prescription Drug plans

*** No need to coordinate with Medicare

After deductible $30 office visit copay after: deductible 20% of allowable amounts: after deductible First-dollar coverage, deductibles and coinsurance apply: Maternity.

Although Con Edison currently sponsors the Retiree Health Program, the information above does not alter the company’s right to change or terminate the program at any time due to changes in laws governing employee benefit plans, the requirements of the Internal Revenue Code, Employee Retirement Income Security Act, or for any other reason. The company is not obligated to contribute any fixed amount or percentage of program costs.

Notice of Privacy PracticesThe Health Insurance Portability and Accountability Act of 1996 (HIPAA) is a federal law that requires Con Edison and the health plans sponsored by the company to protect your personal health information (PHI). As a participant under one of the health plans offered by Con Edison, we are required to notify you of the privacy practices that will be followed by the company and the plans and your rights concerning your personal health information.

Under the law and privacy practices, we have the responsibility to protect the privacy of your personal health information by:

What Does $30 Copay After Deductible Mean

1. limiting who may see it

2. limiting how we may use or disclose it

3. explaining our legal duties and privacy practices

4. adhering to these privacy practices

5. informing you of your legal rights

$25 Copay Before Deductible Mean

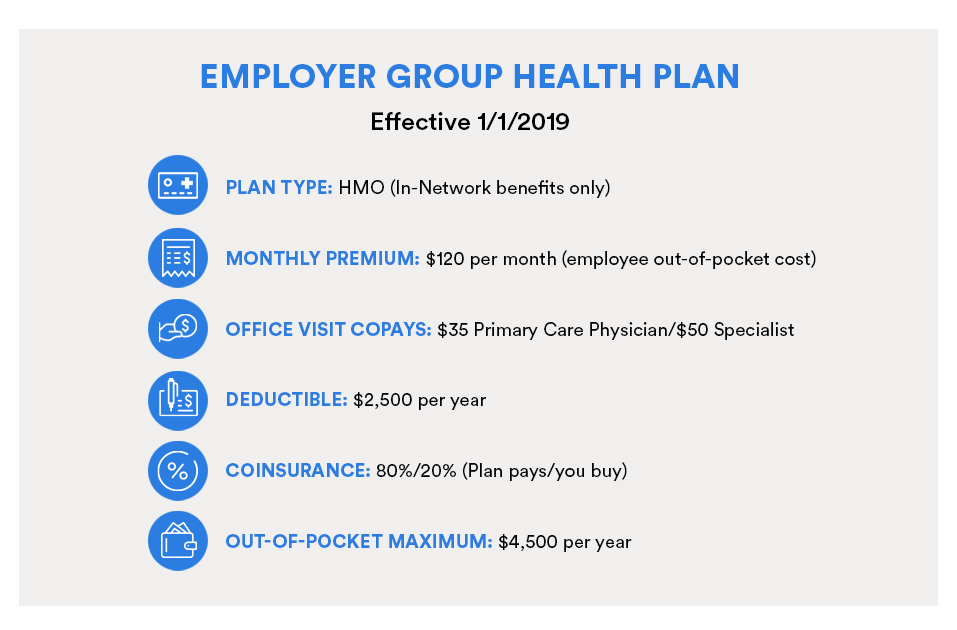

Compare your medical plan options

For 2021, you can choose from two CareFirst BlueCross BlueShield plans—the CareFirst PPO Plan and the CareFirst Health Reimbursement Arrangement (HRA) Plan.

With the CareFirst PPO you’ll pay a bit more for coverage per paycheck but will generally pay less out-of-pocket for office visits. This plan may be a good choice if you know you’ll have lots of doctor visits.

With the CareFirst HRA plan, you’ll pay less per paycheck for coverage, but generally pay a bit more out-of-pocket when you see a doctor or other healthcare provider. This plan also has a higher deductible . However, you will receive money from Sodexo in your HRA to help pay down your deductible. The money in the HRA account will help pay for prescriptions and other healthcare costs. This plan provides out-of-network coverage which allows you and your family members to seek treatment from any provider of your choice and pay a bit more out-of-pocket. Tip: You will pay the least for care when you see in-network providers

You may view the Summary Plan Descriptions (SPDs) and Summary of Benefits and Coverage (SBCs) for these plans on SodexoBenefitsCenter.

This new benefit from Carrum Health connects CareFirst members facing orthopedic surgery (knee, hip, elbow, spine or shoulder) with high-quality surgeons and expert guidance. All surgery costs and most travel expenses, if necessary, will be covered.

30 Dollar Copay After Deductible Mean

Take a Closer Look at Each Plan (In-network Coverage only)

$30 Copay After Deductible Means

CareFirst PPO Plan | CareFirst HRA Plan | ||

|---|---|---|---|

| Annual Deductible | |||

| You | $1,000 | $1,750 | |

| You + Spouse/Partner | $2,000 | $3,500 | |

| You + Child(ren) | $2,000 | $4,175 | |

| Family | $2,000 | $4,500 | |

| Money from Sodexo (only for HRA plan) | |||

| You | No plan account | $750 | |

| You + Spouse/Partner | No plan account | $1,175 | |

| You + Child(ren) | No plan account | $1,175 | |

| Family | No plan account | $1,500 | |

| Copays and Coinsurance | |||

| Preventive Care | $0 (no deductible) | $0 (no deductible) | |

| Primary Care Office Visit | $30 copay | 20% after deductible | |

| Specialist Office Visit | $40 copay | 20% after deductible | |

| Physical, Speech and Occupational Therapy Visits | $15 copay | $15 copay | |

| Video Visit | $0 Urgent care, cost varies for other services | $0 Urgent care, cost varies for other services | |

| Urgent Care | $30 copay | 20% after deductible | |

| Emergency Room | $150 copay (waived if admitted) then 30% after deductible | 20% after deductible | |

| Hospital Coverage | $250 copay, then 30% after deductible | 20% after deductible | |

| Most Other Services | 30% after deductible | 20% after deductible | |

| Out-of-Pocket Maximum | |||

| Individual | $5,000 | $6,350 | |

| Family | $12,700 | $12,700 | |